Experts See Pipeline Growth Potential With Carbon Capture and Storage Systems

The U.S. oil and gas pipeline industry is looking for new opportunities to lay steel in the ground with pipes that carry the carbon dioxide produced when fossil fuels are combusted.

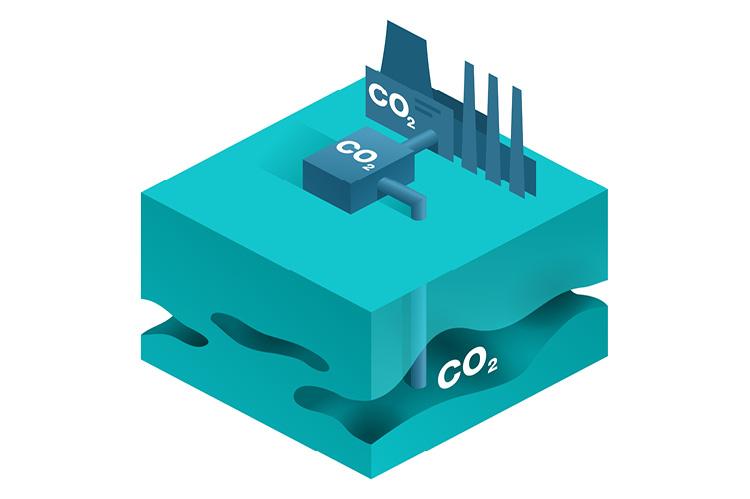

Pipeline operators see a link in carbon capture and storage (CCS) systems, in which CO2 emissions are trapped in underground reservoirs where they can be kept out of the atmosphere. Pipelines would move CO2 from industrial flues to the reservoirs.

CO2 pipelines require thicker walls than typical oil and gas pipes to move condensed, liquefied gas under heavy pressure, limiting prospects for cheaply converting existing infrastructure.

“The capital is going to be large, and obviously existing infrastructure players like ourselves are going to be involved,” Al Monaco, chief executive of Enbridge, a Canadian pipeline company with extensive U.S. assets, told analysts last month.

A July report from the Biden administration’s Council on Environmental Quality said that a CCS industry large enough to help meet the country’s goal of “net zero” emissions by 2050 could require 68,000 miles of new CO2 pipelines at a cost of as much as US$230 billion. That is roughly comparable to U.S. liquid fuel pipeline mileage built since 2000, a boom time for the oil industry.

Jessev Arenivas, head of Kinder Morgan's Energy Transition Venture, sees his company building more oil and gas infrastructure in the future, saying it was “inevitable” that eventually it would be building more pipelines to carry CO2, as well as hydrogen, than fossil fuels. “I do believe it provides a huge growth story,” he added.