China to Fund East African Crude Oil Pipeline, 45 Banks and Insurers Abandon the Project

China has stepped in to provide funding for the implementation of the East African Crude Oil Pipeline (EACOP) project, following the withdrawal of support by more than 45 banks and insurers, Constructionreview reported.

According to the report, Notable financial institutions such as Citi, HSBC, and Munich Re have ruled out backing the infrastructure, with Standard Chartered Bank being the latest to pull out due to pressure from pro-environment activists arguing that the project could generate carbon emissions seven times higher per year than the country's current levels.

In response to the latest events, the East African Crude Oil Pipeline Project team is now racing against time to secure financial closure for the pipeline. The project team is also facing the challenge of completing land acquisition while keeping the 2025 oil production and export schedule, as set by the government, in sight.

EACOP has already signed an agreement with China Petroleum Pipeline Engineering (CPP), a subsidiary of the state-owned China National Petroleum Corporation (CNPC), for the construction and supply of line pipes.

The partnership adds to the involvement of another state entity, China National Offshore Oil Corporation (CNOOC), which holds a 28.33 percent stake in Uganda oil and eight percent in EACOP.

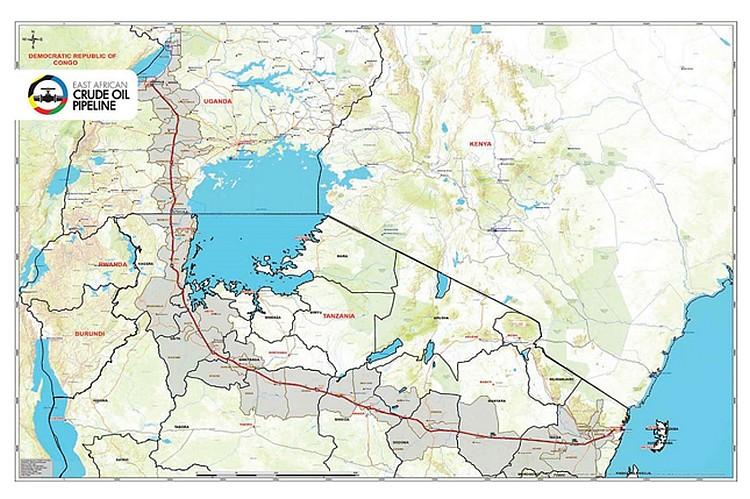

The EACOP is a comprehensive 1,443-kilometer crude export pipeline system designed to transport Uganda's crude oil from Kabaale-Hoima District in Uganda to a maritime port facility on the Chongoleani peninsula in Tanga, Tanzania.

The export pipeline system consists of a 296-kilometer pipeline within Uganda and a 1,147-kilometer pipeline within Tanzania, comprising a 24-inch insulated buried pipeline, six pumping stations (two in Uganda and four in Tanzania), and a maritime export terminal.